August Bulletin 2024

Dear Client

As summer progresses swiftly, with evenings drawing in earlier, it's a good time to reflect on recent events.

On the 1st August, the Bank of England lowered interest rates to 5%, making the first interest rate cut since March 2020. The Labour government’s first budget date was announced for 30th October and in the last 24 hours Prime Minister Keir Starmer has warned that ‘it's going to be painful’, to learn about their tax plans.

This month's ABMV tax bulletin we will be covering:

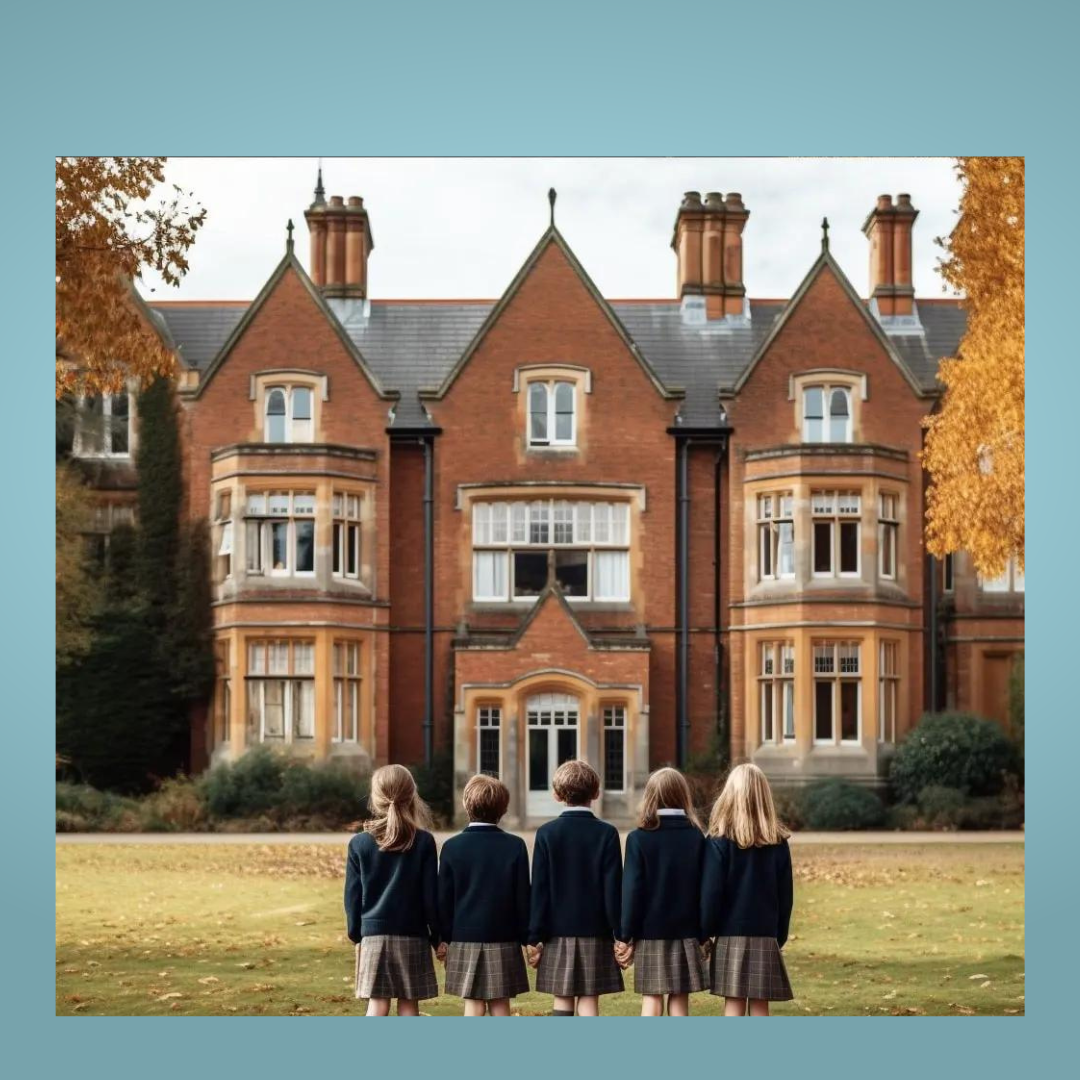

Removal of the VAT exemption on private school fees

Employees must claim PAYE payments

Unpaid tax from cryptocurrency transactions targeted

Warning on HMRC scam letters

HMRC to send Simple Assessment tax statements to pensioners

Removal of the VAT exemption on private school fees

Effective from 1 January 2025, all education services, vocational training, and boarding services provided by private schools or connected entities will be subject to VAT at the standard rate of 20%.

Classes for children of nursery school age will continue to remain exempt from VAT.

The charge will only apply to tuition fees and boarding fees charged by private schools, and adding that the VAT treatment of 'other services' provided by private schools will not change. This means there is no change for services such as nursery care, wrap-around childcare, school meals and holiday clubs, and part-time classes operated by third parties within schools.

Employees must claim PAYE repayments

After the end of the tax year, HMRC checks to see if an employee has paid the correct amount of tax under PAYE. The reconciliations for 2023/24 are in progress.

HMRC will no longer automatically issue a cheque where an employee is due a repayment under pay as you earn (PAYE). Instead, the employee must make an HMRC claim to receive the repayment.

It may be that the employee has paid too much tax, perhaps because they have been put on the wrong tax code. In this case, HMRC will write to the employee and tell them that a repayment is due.

Unpaid tax from cryptocurrency transactions targeted

HMRC is currently writing to individuals who have disposed of cryptoassets such as Bitcoin because the tax treatment is widely misunderstood and therefore tax may have been underpaid.

Most will understand that tax may be due if there is a capital gain once cryptoassets have been sold for cash. However, each time a cryptoasset is disposed of a capital gain may be triggered. This would include the following events:

using cryptocurrency to purchase goods or services

exchanging one type of cryptoasset for another; or

gifting cryptoassets.

In certain circumstances, income tax and NI may be payable. If you receive such a letter from HMRC, you must take action within 60 days even if no tax is due. If you submitted a tax return, the return should be amended where possible. If you did not submit a tax return, or the deadline has passed, you should use the dedicated disclosure service to inform HMRC.

HMRC to send Simple Assessment tax statements to pensioners

HMRC says that in the next few weeks, pensioners will receive a Simple Assessment tax statement where there is an underpayment of income tax for a tax year that cannot be collected automatically via PAYE and they are not subject to income tax self-assessment.

The combination of frozen tax thresholds and a substantial increase to the state pension has led to many more pensioners being dragged into paying income tax for the first time.

The last government froze the personal allowance at £12,570 until 2028.

Warning: Letter said to be from HMRC is a fraud

A letter that asks the recipient to verify financial information with HMRC has not been issued by HMRC and is fraudulent.

The letter is addressed from “Individual and Small Business Compliance” at HMRC. It states that, in response to a recent government initiative, the recipient of the letter should send certain documents to HMRC by email. The documents include the business’ bank statements, accounts and VAT return, and a copy of the driving license for each director. If you are at all unsure about an item of correspondence report it to HMRC and your bank immediately if you have had money stolen.

ABMV Company Update

We have introduced the ability to ePay your invoice through the new ABMV website and/or via the ePay link on your individual invoice. Paying your invoice couldn’t be easier.

If you have any questions or would like to learn more about how we can help you with your accounting and business needs, please don’t hesitate to contact us. Our team of experts is always ready to assist you with any queries you may have.